H. Lee Durham, Jr. Chairman and Audit Committee Financial Expert | ●Committee Meetings in 2023: 11 | | at its discretion and without the prior approval of management or the Boards, retain or obtain the advice of outside consultants or advisors (including legal counsel and other advisors), at our or FCB’s expense, in accordance with procedures established from time to time by the committee, and oversee and approve all terms of the engagement of any such consultants or advisors, including their fees or other compensation;

|

| ● | | conduct investigations and request and consider information (from management or otherwise) as the committee considers necessary, relevant, or helpful in its deliberations and the formulation of its decisions or recommendations;

Other Committee Members (1): |

| ● | | seek any information from our or FCB’s associates (who are directed to cooperate with each committee’s requests), or from external parties, and consult to the extent it deems appropriate with the Chairman of the Boards, the Chief Executive Officer, the Lead Independent Director, other directors, and other officers and associates;

John M. Alexander, Jr., Michael A. Carpenter, David G. Leitch, and Robert T. Newcomb

|

| ● | | delegate any of its responsibilities to subcommittees or to individual members to the extent not inconsistent with other sections of its charter (including applicable independence requirements) or applicable laws or regulations.

|

Each committee(1) Floyd L. Keels served as a member may rely on the advice, expertise and integrity of persons (including our and FCB’s officers and associates) and organizations that provide information to the committee, and the accuracy and completeness of the financial and other information provided to the committee, absent actual knowledge that such reliance is not reasonable or warranted. In the performance of each committee’s responsibilities, each committee member (and the committeeCommittee until his death on October 30, 2023. Mr. Leitch was appointed as a whole) is undermember of the Committee upon his appointment as a continuing duty to exercise independent judgment on an informed basis, in good faith, and in a manner each considers to be in our and FCB’s best interests.

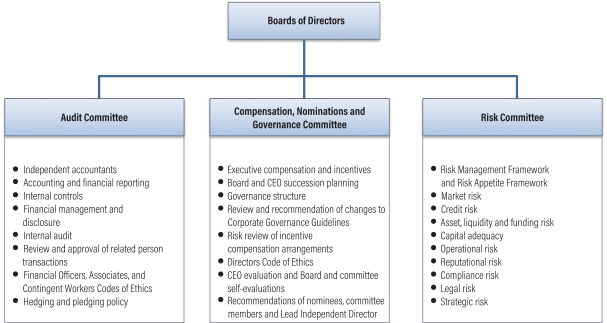

Audit Committee

| | | | | | | H. Lee Durham, Jr.

Chairman and

Audit Committee Financial Expert

Committee Meetings in 2021: 11

| | Other Committee Members:

John M. Alexander, Jr., Michael A. Carpenter (1), Daniel L. Heavner and

Floyd L. Keels

(1) Mr. Carpenter became a member of the Audit Committee on January 3, 2022.director effective January 1, 2024.

|

| | | Our Audit Committee is a joint committee of our and FCB’s Boards of Directors.the Boards. In addition to being independent directors under the SEC’s rules and Nasdaq’s listing standards, under the Committee’s charter all members must be able to read and understand fundamental financial statements, and at least two members must have banking or related financial management expertise sufficient to comply with applicable regulations of the Federal Deposit Insurance Corporation.FDIC. At least one member must have past employment experience in finance or accounting, professional certification in accounting, or other comparable experience or background, which fulfillsthat will fulfill Nasdaq’s applicable financial sophistication requirements. In addition to its other dutiesresponsibilities, including those listed in the table, the Audit Committee annually reviews and responsibilities under its charter or as may be assigned from timeapproves our Regulation Fair Disclosure (FD) Policy, and it annually reviews and approves our accounting policies to time bydetermine that they are in accordance with accounting principles generally accepted in the Boards, the Committee is responsible for: | ● | | appointing, determining the compensation and terms of engagement of, and monitoring and overseeing the work, independence and performance of, our independent accountants and any other accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services;

|

| ● | | approving all audit and permitted non-audit services proposed to be provided by our independent accountants in accordance with approval policies and procedures adopted by the Committee from time to time;

|

| ● | | monitoring and overseeing the quality and integrity of our accounting and financial reporting process, and reviewing our annual audited and quarterly unaudited financial statements and quarterly earnings releases, and any significant accounting and financial reporting issues, with management and our independent accountants;

|

| ● | | monitoring our systems of internal controls regarding finance, accounting and associated legal compliance, and reviewing and discussing any significant deficiencies or material weaknesses in the design or operation of internal controls that could adversely affect our ability to record, process, summarize and report financial data;

|

| ● | | monitoring and overseeing the audit program of our Internal Audit Department;

|

| ● | | annually reviewing our Associates Code of Ethics, Financial Officers Code of Ethics, and Contingent Workers Code of Ethics, recommending to the Boards any changes to the Codes that the Committee considers necessary or advisable, and overseeing management’s processes and procedures for enforcement of the Codes;

|

| ● | | fostering free and open communication among our independent accountants, management, Internal Audit Department and the Boards; and

|

| ● | | monitoring our and FCB’s compliance with laws, rules, regulations or other governmental or regulatory requirements as they affect accounting and financial processes and reporting, internal controls and auditing matters.

|

United States of America. The Audit Committee also is responsible for establishing procedures for the receipt, retention, and treatment of complaints from associates, customers, suppliers, shareholdersstockholders, or others related to accounting and financial processes and reporting, internal controls, and auditing matters, including procedures for the confidential, anonymous submission by associates of concerns regarding those matters, and for evaluating any fraud, whether or not material, that involves management or other associates who have a significant role in our internal controls. The | | | | AUDIT COMMITTEE RESPONSIBILITIES | | In addition to its other duties and responsibilities under its charter or as may be assigned from time to time by the Boards, the Audit Committee reviews waivers approvedis responsible for: ● appointing, determining the compensation and terms of engagement of, and monitoring and overseeing the work, independence, and performance of, our independent accountants and any other accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services; ● pre-approving all audit and permitted non-audit services proposed to be provided by our independent accountants in accordance with approval policies and procedures adopted by the Committee from time to time; ● monitoring and overseeing the quality and integrity of our accounting and financial reporting process, and reviewing our annual audited and quarterly unaudited financial statements and quarterly earnings releases, and any significant accounting and financial reporting issues, with management and our independent accountants; ● monitoring our systems of internal controls regarding finance, accounting, and associated legal compliance, and reviewing and discussing any significant deficiencies or material weaknesses in the design or operation of internal controls that could adversely affect our ability to record, process, summarize, and report financial data; ● monitoring and overseeing the audit program, budget, and resources of our Internal Audit Department. and approving the hiring, annual performance, and compensation of our Chief Risk Officer related to associates under theInternal Audit Officer; ● annually reviewing our Associates Code of Ethics, and Contingent Workers Code of Ethics, but only the full Board may approve a waiver under the Financial Officers Code of Ethics, and Non-Employee Workers Code of Ethics, recommending to the Boards any changes to the Codes that the Committee considers necessary or related to an executive officer or memberadvisable, and overseeing management’s processes and procedures for enforcement of the Board. UnderCodes; ● fostering free and open communication among our independent accountants, management, Internal Audit Department, and the Boards’ written policies described below under the headingsBoards; and ● monitoring our and FCB’s compliance with laws, rules, regulations, or captions “TRANSACTIONSWITH RELATED PERSONS,”other governmental or regulatory requirements as they affect accounting and “BENEFICIAL OWNERSHIPOFOUR COMMON STOCK — Pledging Policy,” the Committee is responsible on an ongoing basis for reviewingfinancial processes and approving certain transactions, arrangements or relationships with us or FCB in which one of our related persons has a material interest,reporting, internal controls, and for reviewing and approving any requests by an executive officer or director for an exception to our pledging policy and monitoring any outstanding pledges of our stock by any of them. auditing matters. |

| | | | | | | 2024 Annual Proxy Statement  | | 31 |

Committees of Our Boards The Committee reviews waivers approved by our Chief Risk Officer related to associates under the Associates Code of Ethics and Non-Employee Workers Code of Ethics, but only the full Board may approve a waiver under the Financial Officers Code of Ethics or related to an executive officer or member of the Board. Under the Boards’ written policies described below under the heading “TRANSACTIONS WITH RELATED PERSONS,” the Committee is responsible on an ongoing basis for reviewing and approving certain transactions, arrangements, or relationships with us or FCB in which one of our related persons has a material interest. The Committee annually reviews and approves our Hedging and Pledging Policy described below under the captions “BENEFICIAL OWNERSHIP OF OUR COMMON STOCK – Hedging Policy” and “– Pledging Policy,” and it is responsible for reviewing any requests by an executive officer or director for an exception to our pledging policy and monitoring any outstanding pledges of our stock by any of them. The Committee selects and appoints, and reviews various reports from, our independent accountants (including their annual report on our audited consolidated financial statements), financial reports we file under the Exchange Act, and reports of examinations by our regulatory agencies. Our Chief Internal Audit Officer reports directly to our Audit Committee. At least quarterly, the Committee reviews reports on the work performed by FCB’s Corporate Finance Department. Our Chief Compliance Officer reports to the Committee regarding transactions with our related persons, as well as all reports of internal suspicious activity, and reports of external suspicious activity above certain amounts, filed by FCB. The Disclosure Committee and the Allowance Committee are management committees comprised of members selected from our management which report directly to the Audit Committee and assist it in the performance of its duties. Information regarding the process for and factors considered in the Audit Committee’s selection of our independent accountants is contained under the heading “PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS.” Audit Committee Financial Expert. H. Lee Durham, Jr., the Committee Chairman and one of our independent directors, is a retired partner in the accounting firm of PricewaterhouseCoopers LLP. Upon his retirement from public accounting, he had 32 years of public accounting and audit experience, much of which involved financial institutions and other public companies. Our Board of Directors has designated Mr. Durham as the Committee’s “Audit Committee Financial Expert,” as that term is defined by the rules of the SEC. Audit Committee Report This report is furnished by the Audit Committee, the members of which, on the date of the filing of our 2023 Annual Report, are named below. Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for the preparation of our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those financial statements. The Audit Committee oversees and reviews those processes. In connection with the preparation and audit of our consolidated financial statements for 2023, the Committee has: | ● | | reviewed and discussed our audited consolidated financial statements for 2023 with our management; |

| ● | | discussed with our independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC; |

| ● | | received the written disclosures and the letter from our independent accountants (including their annual report on our audited consolidated financial statements), financial reports we file underrequired by applicable requirements of the Securities Exchange Act of 1934,Public Company Accounting Oversight Board regarding the independent accountants’ communications with the Audit Committee concerning independence; and reports of examinations by our regulatory agencies. Our Chief Internal Audit Officer reports directly to our Audit Committee. At least quarterly, the Committee reviews reports on the work performed by FCB’s Corporate Finance Department. Our Chief Compliance Officer reports to the Committee regarding transactions |

| ● | | discussed with our related persons, as well as all reports of internal suspicious activity, and reports of external suspicious activity above certain amounts, filed by FCB. Information regardingindependent accountant the process for and factors considered in the Audit Committee’s selection of our independent accountants is contained under the heading “PROPOSAL 3: RATIFICATIONOF APPOINTMENTOF INDEPENDENT ACCOUNTANTS.”accountant’s independence.

Audit Committee Financial Expert.

|

Based on the above reviews and discussions, the Audit Committee recommended to our Board that our audited consolidated financial statements be included in our 2023 Annual Report. The Audit Committee: | | | | | | | | | | H. Lee Durham, Jr. | | John M. Alexander, Jr. | | Michael A. Carpenter | | David G. Leitch | | Robert T. Newcomb |

| | | | | | 32 | |  2024 Annual Proxy Statement 2024 Annual Proxy Statement

| | |

Committees of Our Boards Risk Committee | | | Robert R. Hoppe Chairman and Risk Management Expert Committee Meetings in 2023: 12 | | Other Committee Members (1): Ellen R. Alemany, Victor E. Bell III, Dr. Eugene Flood, Jr., and Robert E. Mason IV

(1) Vice Admiral John R. Ryan, USN (Ret.), served as a member of the Committee Chairman and one of our independent directors, is a retired partner induring 2023 until the accounting firm of PricewaterhouseCoopers LLP. He has 32years of public accounting and audit experience, much of which involved financial institutions and other public companies. Our Board of Directors has designated Mr. Durham as the Committee’s “Audit Committee Financial Expert,” as that term is defined by the rules of the SEC. Audit Committee Report

This report is furnished by the Audit Committee, the members of which, on the date of the filing of our2023 Annual Report on Form 10-K for the year ended December 31, 2021, are named below.

Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for the preparation of our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those financial statements. The Audit Committee oversees and reviews those processes. In connection with the preparation and audit of our consolidated financial statements for 2021, the Committee has:

| ● | | reviewed and discussed our audited consolidated financial statements for 2021 with our management;

|

| ● | | discussed with our independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC;

|

| ● | | received the written disclosures and letter from our independent accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the accountants’ communications with the Committee concerning independence; and

|

| ● | | discussed with our independent accountant the independent accountant’s independence.

|

Based on the above reviews and discussions, the Committee recommended to our Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC.

The Audit Committee:

| | | | | | | | | H. Lee Durham, Jr.

| | John M. Alexander, Jr. | | Michael A. Carpenter | | Daniel L. Heavner | | Floyd L. Keels |

Risk Committee

| | | | | | | Robert R. Hoppe

Chairman and

Risk Management Expert

Committee Meetings in 2021: 7

| | Other Committee Members:

Victor E. Bell III, Robert E. Mason IV and

Vice Admiral John R. Ryan, USN (Ret.) (1)

(1) Mr. Ryan became a member of the Risk Committee on January 3, 2022.Meeting.

|

| | | Our Risk Committee is a joint committee of ourthe Boards. Under the Federal Reserve Board’s rules and FCB’s Boardsthe Risk Committee’s charter, the Committee must be chaired by an independent director and must include at least one member having experience in identifying, assessing, and managing risk exposures of Directors.large, complex financial firms. Our Board has designateddetermined that Robert R. Hoppe, the Committee’s Chairman, has that experience and has designated him as the Committee’s Risk Management Expert. Mr. Hoppe is a retired partner in the accounting firm of PricewaterhouseCoopers LLP with 34 years of public accounting and audit experience. In addition to Mr. Hoppe, the Board has determined that two other members of the Committee, Ellen R. Alemany and Dr. Eugene Flood, Jr., also have experience in identifying, assessing, and managing risk exposures of large, complex financial firms that satisfies the requirements of the Federal Reserve Board’s rule. The

In addition to its other responsibilities, including those listed in the table, the Risk Committee was established to review, effectivelyprovide effective challenge, and approve our enterprise-wide Risk Management Framework and Risk Appetite Framework and to assist the Boards in fulfilling their responsibility to oversee our risk management practices. Our Enterprise Risk Oversight Committee (“EROC”), whose voting members are selected from our management and which is chaired by our Chief Risk Officer, is a management committee that reports directly to the Risk Committee. EROC’s function is to oversee the operation of our Risk Management Framework | | | | RISK COMMITTEE RESPONSIBILITIES | | In addition to its other duties and responsibilities under its charter or as may be assigned from time to time by the Boards, the Risk Committee is directed to: | ● | | monitor and advise the Boards regarding our and FCB’s risk exposures, including capital adequacy, credit, market, liquidity, operational (Including human capital and information technology), compliance, legal, strategic, reputational and other

● monitor and advise the Boards regarding our and FCB’s risk exposures, including, without limitation, capital adequacy, credit, market, liquidity, operational (including human capital and information technology), compliance, legal, strategic, asset, and reputational risks and the control processes with respect to those risks; |

| ● | | ●evaluate, monitor, effectively challenge, and oversee the adequacy and effectiveness of our and FCB’s risk management program and supporting framework (within which our management is responsible for defining and executing enterprise-wide risk management programs) which are intended to ensure appropriate risk identification, assessment, monitoring, and reporting of significant risks; |

| ● | | ●review and assess our and FCB’s strategy to validate that it is aligned with our and FCB’s strategy to validate that it is aligned with FCB’s risk profile and financial objectives; |

| ● | | ●monitor the work of and receive and challenge reports from management and our Enterprise Risk Oversight Committee (described below) to determine whether risks are being identified (including top and emerging risks) and managed within approved risk tolerances; |

| ● | | review, approve, challenge, and monitor adherence to our and FCB’s risk appetite and supporting risk tolerance levels;

|

| ● | | review reports of examination by and communications from regulatory agencies, and the results of internal and third-party testing, analyses and reviews, related to our and FCB’s risks, risk management, and any other matters within the scope of the Committee’s oversight responsibilities, and monitor and review management’s response to any noted issues; and

|

| ● | | review and approve our Board level risk management policies on an annual basis to confirm consistency and compliance with risk appetite.

|

Our Enterprise Risk Oversight Committee (“EROC”), whose voting membersto determine whether risks are selected from our managementbeing identified (including top and chaired by our Chief Risk Officer, reports directly to the Risk Committee. EROC’s function is to oversee the operation of our Risk Management Frameworkemerging risks) and Risk Appetite Frameworkmanaged within approved by the Risk Committee; work with our business units to implement processes to identify, assess, monitor and manage their risks;risk tolerances;

● review, approve, challenge, and monitor performance relativeadherence to our and FCB’s risk appetite and tolerances approved bysupporting risk tolerance levels; ● monitor the Risk Committee. Subcommitteeswork of EROC include the Asset/Liability Committee, Compliance Risk Committee,and receive and challenge reports from Credit Risk Committee, Operational Risk Committee, Capital PlanningReview to determine whether credit risks are being identified and Stress Testing Committee,managed within approved risk tolerances; ● review reports of examination by and Technology Investment Committee, eachcommunications from regulatory agencies, and the results of which has its own subcommittees or “councils” that focus on specific matters within their areas of responsibility. Our Chief Risk Officer reports directlyinternal and third-party testing, analyses, and reviews, related to the Risk Committee regarding capital risk, market risk, liquidity risk, credit risk, operational risk, compliance risk and strategic risk. Our Chief Credit Officer, Chief Compliance Officer, Treasurer, Enterprise and Operational Risk Executive, and officers within our Legal Department and other departments within our and FCB’s operations, also make quarterly reportsrisks, risk management, and any other matters within the scope of the Committee’s oversight responsibilities, and monitor and review management’s response to the Risk Committee.any noted issues; and ● review and approve our Board level risk management policies on an annual basis to confirm consistency and compliance with risk appetite. |

and Risk Appetite Framework approved by the Risk Committee; work to ensure adequate implementation of processes to identify, assess, monitor, and manage risks within business units; and monitor performance relative to our risk appetite and tolerances approved by the Boards. | | | | | | | 2024 Annual Proxy Statement  | | 33 |

Committees of Our Boards Subcommittees of EROC are listed in the table, each of which may have its own “councils” that focus on specific matters within their areas of responsibility. The Risk Committee receives regular reports from business and independent risk functions regarding capital risk, market risk, asset risk, liquidity risk, credit risk, operational risk (including human capital and cyber risks), reputational risk, compliance risk, and strategic risk. | | | As discussed above under the caption “CORPORATE GOVERNANCE“CORPORATE GOVERNANCE —Human Capital Management,” the Risk Management Framework approved by the Risk Committee includes processes for the oversight and management of risks related to our human capital and the escalation of related risk issues to the Committee. TheOur Operational Risk Committee and Compliance Risk Committee, which are subcommittees of EROC, through the Human Resources Department, monitorsour human resources department, monitor various human capital metrics, including various associate voluntary and involuntary turnover, attrition, hiring, succession, associate demographics, and other metrics,metrics. Quarterly reports and reports results and trends are provided to EROC, which includesreports identified risk issues in its quarterly reports to the Risk Committee. The Risk Committee also periodically reviews information security policies and technology risk management programs and practices that are designed to protect FCB’s and its customers’ and associates’ data, records, and proprietary information, and it reviews reports on our business continuity and disaster recovery program that is designed to permit FCB to safeguard associates, customers, products | | | | SUBCOMMITTEES OF EROC | | Subcommittees of EROC include: ● the Financial Risk Committee, ● the Compliance Risk Committee, ● the Credit Risk Committee, ● the Operational Risk Committee, ● the Technology Security and services from disruptions such as cyber events, natural disasterRisk Committee, ● the Asset and man-madeLiability Committee, ● the Capital and Stress Testing Committee, and ● the Technology Investment Committee. |

to help FCB safeguard associates, customers, products, and services from disruptions from events such as cyberattacks, natural disasters, and man-made events. Certain matters within the scope of the Risk Committee’s oversight responsibilities also may fall within the scope of the oversight responsibilities of other committees of the Boards. To minimize the duplication of time and effort, the Risk Committee may defer to those other committees with respect to any such specific matters, but it may request reports or information from those other committees to determine whether those matters are being adequately addressed within our and FCB’s Risk Management Framework. Additional information regarding the Risk Committee’s processes is contained in the discussion under the caption “CORPORATE GOVERNANCE — Boards’ Role in Risk Management.” | | | | | | 34 | |  2024 Annual Proxy Statement 2024 Annual Proxy Statement

| | |

Committees of Our Boards Trust Committee | | | John M. Alexander, Jr. Chairman Committee Meetings in 2023: 4 | | Other Committee Members (1): Hope H. Bryant and Dr. Eugene Flood, Jr.

(1) Floyd L. Keels served as a member of the Committee until his death on October 30, 2023. |

| | | In accordance with guidance from banking regulators that applies to banks with trust departments, FCB’s Board of Directors has a separate Trust Committee. The Committee must be comprised of not less than three members of FCB’s Board, including at least one independent director, who will be voting members and one of whom will be appointed as the Committee chairperson. The Committee may include no more than one director who also serves as an officer of FCB (who may not be an officer who participates significantly in the administration of FCB’s fiduciary responsibilities). In addition to its other responsibilities listed in the table, the Trust Committee’s primary purpose is to assist FCB’s Board in its oversight and supervision of FCB’s administration and exercise of fiduciary responsibilities and other trust activities and in its oversight of risks associated with those activities. Management subcommittees of the Trust Committee include the Trust Risk Management Committee, Trust Investment Committee, and the Trust Administrative Committee, the voting members of which are selected from our management and which report directly to the Committee and assist it in the performance of its duties. | | | | TRUST COMMITTEE RESPONSIBILITIES | | In addition to its other duties and responsibilities under its charter or as may be assigned from time to time by FCB’s Board, the Trust Committee is directed to: ● review and approve the Trust Department’s policies; ● review and decide whether to approve and/or ratify exceptions to Trust Committee-approved policies; ● review and assess the adequacy of the committee’s charter at least annually and recommend any proposed changes to FCB’s Board for consideration; ● review and approve any management committee charters at least annually and any recommended revisions; ● review and approve the regularly published fee schedules for Trust Department services; ● review and recommend for approval by FCB’s Board, in accordance with applicable state statutes, the quarterly purchases and sales for discretionary accounts administered by the Trust Department; ● review and receive the minutes of the management committees; ● provide an appropriate level of effective challenge to the first and the second lines within the scopeTrust Department; ● ensure the application of FCB’s conduct and ethical standards to, and the ethical environment within, the Trust Department; ● oversee the administration of client accounts by the Trust Department to ensure that it is in conformance with the FDIC’s Statement of Principles of Trust Department Management; ● oversee the organizational structure of the Risk Committee’s oversight responsibilities also may fallTrust Department, including establishment of divisions or groups within the responsibilitiesTrust Department, and the names used by the Trust Department and its divisions or groups offering fiduciary services; ● oversee the investment and disposition of anotherassets held by the Trust Department, and monitor financial performance of investments made and investment strategies and processes utilized; ● ensure records and recordkeeping practices of the Boards’ committees. To minimize duplication of timeTrust Department are in compliance with any applicable rules or regulations; and effort, the Risk Committee may defer to the other committees with respect to any such specific matters, but it may request reports or information from those other committees to determine whether those matters are being adequately addressed within our and FCB’s management of risk. Additional information regarding the Risk Committee’s processes is contained in the discussion under the caption “CORPORATE GOVERNANCE — Boards’ Role in Risk Management.” Compensation, Nominations and Governance Committee

| | | | ● oversee the use of vendors, services, and products by the Trust Department including, but not limited to, accounting and information systems and clearing arrangements. | | | |

Robert T. Newcomb

Chairman and

Lead Independent Director

| | | | | | | 2024 Annual Proxy Statement  | | 35 |

Committees of Our Boards Committee Meetings in 2021: 6

| | Other Committee Members:

Victor E. Bell III, H. Lee Durham, Jr. and Robert E. Mason IV

|

Our Compensation, Nominations and Governance Committee

| | | Robert T. Newcomb Chairman and Lead Independent Director Committee Meetings in 2023: 10 | | Other Committee Members (1): Victor E. Bell III, H. Lee Durham, Jr., David G. Leitch, and Robert E. Mason IV

(1) Mr. Leitch was appointed as a member of the Committee upon his appointment as a director effective January 1, 2024. |

| | | The CNG Committee is a joint committee of our and FCB’s Boards of Directors.the Boards. In addition to being independent directors under Nasdaq’s listing standards, under its charter members of the Committee must satisfy Nasdaq’s heightened independence requirements for members of compensation committees. The

As described in the following paragraphs, the Committee’s duties and responsibilities are divided into three areas as described in the following paragraphs.functions, including nominations, corporate governance, and compensation.

Nominations Function.In its role as the Boards’ nominations committee, the CNG Committee makes recommendations to the Boards regarding the selection of nominees for election as directors at our Annual Meetings, candidates for appointment to fill vacancies on the Boards, and candidates for appointment as the members and chairpersons of the various committees of the Boards. Each year the Committee also makes recommendations to the Boards regarding the selection of our and FCB’s Chairman, Chief Executive Officer, Vice ChairwomenChairwoman and President and a recommendation to our independent directors regarding their selection of a Lead Independent Director. In its Board succession planning, the Committee applies a process which includes: assessment of needs and vacancies; development of candidate criteria; assembly of a candidate pool; screening, recruiting, and interviewing candidates; selection and appointment or nomination of selected candidates; and orientation and integration of new directors. The Committee seeks to identify and recommend candidates who will best serve our and our stockholders’ interests. In identifying potential candidates and recommending nominees, the Committee considers incumbent directors as well as candidates who may be suggested by our management, other directors, or stockholders. The procedure for stockholders to recommend candidates to the Committee is contained below under the heading “RECOMMENDATIONS OF NOMINEES.” | | | | QUALIFICATIONS OF DIRECTOR CANDIDATES | | The CNG Committee seeks to recommend Board candidatescandidates: ● who have personal and professional integrity, sound judgment, and business acumen; ● who have the time, ability, and commitment to make a constructive and meaningful contribution to the Boards; and ● who, with other directors, will effectively serve the long-term interests of our shareholders. Candidates also muststockholders; and ● who satisfy applicable requirements of state and federal laws, rules, and regulations (including banking regulations) for service as our and FCB’s directors. Under our Bylaws, to be eligible for election and continued service as a director, a person must own at least 100 shares of our common stock, individually in his or her own name, jointly with his or her spouse, or in an account for his or her direct benefit. From time to time the Committee or our Board may develop other criteria or minimum qualifications for use in identifying and evaluating candidates to serve as directors. Our Board makes all final decisions regarding nominations. In identifying potential candidates, the Committee considers incumbent directors as well as candidates who may be suggested by our management, other directors or shareholders. A description of procedures to be followed by shareholders in submitting recommendations to the Committee is included in this proxy statement under the heading “RECOMMENDATION

| | | | | | EVALUATION OF NOMINEES.” DIRECTOR CANDIDATES | | The Committee has not used the services of a third-party search firm. In identifying and recommending candidates for election or appointment, the Committee will evaluate candidates recommended by shareholders in a manner similar to its evaluation of other candidates. TheCNG Committee considers the size and composition of the Boards in light of our current and future needs and recommends candidates based on its assessment of, among other things: (1)

● business, professional, personal, and educational background, skills, experience, and expertise; (2) ● community leadership; (3) ● independence; (4) ● potential contributions to the Boards that are unusual or unique; (5) ● knowledge of our organization and our and FCB’s respective operations; (6) ● personal financial interest in our and FCB’s long-term growth, stability, and success; (7) ● the performance and past and future contributions of our current directors, and the value of continuity and prior Board experience; (8) ● the existence of one or more vacancies on the Boards; (9) ● our need for directors possessing particular attributes, skills, experience, or expertise; (10) ● the role of directors in FCB’s business development activities; (11) diversity;activities, ● diversity of individuals who bring different attributes, experiences and (12)perspectives to deliberations; and ● other factors that it or our Boards consider relevant, including any specific qualifications that may be adopted from time to time. |

| | | | | | 36 | |  2024 Annual Proxy Statement 2024 Annual Proxy Statement

| | |

Committees of Our Boards | | | While the Committee and our Boards recognize the benefits derived from boards of directors composed of individuals who bring different attributes, experiences, and perspectives to the Boards’ deliberations, and while diversity is a consideration in the selection of nominees, they have not adopted any written or mandatory diversity policy or criteria applicable to the director nominations process. Accordingly, in evaluating and selecting nominees, diversity is one of the multiple factors considered by the Committee and the Board.Boards. In recommending that our Board of Directors nominate our current 14 directors for re-election at the Annual Meeting, the Committee considered, among other things, the factors described above and the specific qualifications of each director described in his or her listing as a nominee under the caption “PROPOSAL 1: ELECTIONOF DIRECTORS — Nominees.” Additionally, with respect to directors who were members of our Board during 2021, the Committee considered each director’s preparedness for, engagement in and contributions to meetings and deliberations of the Board and committees on which they serve, and, in the case of the three former CIT directors who were appointed as our directors upon consummation of our merger with CIT, the Committee took into account our obligations under our merger agreement with CIT. After its consideration of these factors, the Committee recommended to our Board of Directors that our 14 current directors be nominated for re-election for new terms of office.

Governance Function. In its role as the Boards’ joint governance committee, and among its otherthe CNG Committee has a range of governance-related responsibilities under its charter or as may be assigned to it from time to time by the Boards, the Committee:responsibilities. | ● | | evaluates and makes recommendations to the Boards concerning our board and governance structure, the number, size, composition and responsibilities of committees of the Boards, and committee membership rotation practices;

|

| ● | | annually reviews our Corporate Governance GuidelinesIn addition to its responsibilities listed in the table, and recommends for our Board’s approval any changes that it considers necessary or advisable;

|

| ● | | establishes the knowledge, skills, experience, qualifications and performance criteria for directors and committees of the Boards in accordance with our strategic needs, our Corporate Governance Guidelines, applicable laws, regulations and standards, and other criteria or minimum qualifications as the Committee may recommend;

|

| ● | | annually reviews our Directors Code of Ethics, reviews directors’ compliance with the Code, evaluates and makes recommendations to the Boards concerning any request for a waiver from the Code, and oversees our management’s processes and procedures for enforcement of the Code;

|

| ● | | conducts periodic evaluations of our Chief Executive Officer’s performance, and coordinates and facilitates an annual self-evaluation by the Boards and their committees of their own performance, and reports the results of the evaluations to the Boards;

|

| ● | | with the Chairman of the Boards and our Corporate Secretary, develops an orientation program for new directors and continuing education opportunities for incumbent directors;

|

| ● | | oversees our communications with shareholders in connection with our Annual Meetings and “say-on-pay” resolutions; and

|

| ● | | makes recommendations to the Boards as appropriate regarding succession planning for key Board positions, our Chief Executive Officer and President, and other key positions as the Boards may request.

|

As provided in our Corporate Governance Guidelines and described above under the caption “CORPORATE GOVERNANCE“CORPORATE GOVERNANCE — Director Independence,” our Board also has directed the Committee to annually assess each outside director’s independence and report its findings in connection with the Board’s annual review of transactions, relationships and other arrangements involving our directors and determination of which of the directors the Board considers to be “independent.” Between those annual determinations, on an ongoing basis the Committee is directed to monitor the status of each director and inform the Board of changes or events that may affect a director’s ability to exercise independent judgment.

| | | | Compensation Function.

GOVERNANCE RELATED RESPONSIBILITIES | | In addition to its roleother duties and responsibilities under its charter or as may be assigned from time to time by the Boards, as the Boards’ joint compensationgovernance committee of the Boards, the Committee reviews and provides overall guidance to the Boards regarding our executive compensation and benefit programs. Under its charter, theCNG Committee is directed to establish our overall compensation philosophyto: ● evaluate and determine the overall risk profile of our compensation program and practices, and to at least annually review all of our and FCB’s compensation plans, including all incentive and variable pay plans within specific divisions of FCB, to (1) determine whether there are potential areas of risk that reasonably could be expected to have a material adverse effect on our business and financial results, and (2) ensure continuing oversight and mitigation of risk within our and FCB’s compensation practices. Among its other duties, the Committee administers and approves all grants and payments of awards under FCB’s Long-Term Incentive Plan (the “LTIP”), and it reviews and makesmake recommendations to the Boards regarding all other executive compensation matters, including:concerning our board and governance structure, the number, size, composition, and responsibilities of committees of the Boards, and committee membership rotation practices; | ● | | amounts of cash and other compensation paid or provided to, and the adoption of or revisions to compensation, incentive, retirement, or other benefit plans that affect, our and FCB’s Chief Executive Officer and other executive officers; and

|

● annually review our Corporate Governance Guidelines and recommend for our Board’s approval any changes the Committee considers necessary or advisable; | ● | | at the request of the Boards, amounts of cash and other compensation paid or provided to, and the adoption of or revisions to compensation, incentive, retirement, or other benefit plans that affect, other individually named officers or associates.

● establish the knowledge, skills, experience, qualifications, and performance criteria for directors and committees of the Boards in accordance with our strategic needs, our Corporate Governance Guidelines, applicable laws, regulations and standards, and other criteria or minimum qualifications as the Committee may recommend; ● annually review our Directors Code of Ethics, review directors’ compliance with the Code, evaluate and make recommendations to the Boards concerning any request for a waiver from the Code, and oversee our management’s processes and procedures for enforcement of the Code; ● conduct annual evaluations of our Chief Executive Officer’s performance, and coordinate and facilitate an annual self-evaluation by the Boards and their committees of their own performance, and report the results of the evaluations to the Boards; ● with the Chairman of the Boards and our Corporate Secretary, develop an orientation program for new directors and continuing education opportunities for incumbent directors; ● oversee our communications with stockholders in connection with our Annual Meetings and otherwise; and ● make recommendations to the Boards as appropriate regarding succession planning for key Board positions, our Chief Executive Officer, and other key positions as the Boards may deem appropriate. |

Compensation Function. In its role as the joint compensation committee of the Boards, the CNG Committee reviews and provides overall guidance to the Boards regarding our executive compensation and benefit programs. After receiving the Committee’s recommendations, the Boards make all final decisions regarding executive compensation matters, with the exception of payments and awards under the LTIP and MPP which are the sole responsibility of the Committee. The Committee also reviews and makes recommendations to the Boards regarding amounts of compensation paid or provided to our directors. | | | | | | | 2024 Annual Proxy Statement  | | 37 |

Committees of Our Boards | | | In its review and consideration of compensation matters, the Committee works closely with our Chief Human Resources Officer and his staff. In considering compensation to be paid to our directors and our executive officers named in the Summary Compensation Table below, the Committee considers information provided bythe results of its annual evaluation of our Chairman and Chief Executive Officer, including,Officer’s performance and, in the case of officers other than himself, information provided from time to time by our Chief Executive Officer about those officers’ individualtheir performance and his recommendations as to their compensation. The Committee may retain or obtain the services of outside consultants or other advisors at our or FCB’s expense, and under its charter the Committee is directly responsible for the appointment, compensation, terms of engagement, and oversight of the work of its consultants and advisors. Since 2013, the Committee has retained the services of Pay Governance LLC (“Pay Governance”), which is a national executive compensation consulting firm and which also served as compensation consultant to CIT’s Board of Directors’ independent Compensation Committee. Pay Governance’s engagement each year contemplates that it will prepare market | | | | COMPENSATION RELATED RESPONSIBILITIES | | In addition to its other duties and peer analyses comparing our executives’ and directors’responsibilities under its charter or as may be assigned from time to time by the Boards, as the Boards’ joint compensation rates tocommittee the market compensation paid by similar financial services organizations to their officers and directors in similar positions, advise the Committee regarding its responsibilities and developments in compensation rules and practices, consult with our management and the Committee regarding our annual and strategic plans and the formulation of their compensation recommendations, and assist the Committee in its consideration of new, and changes to existing, compensation plans and strategies. Pay Governance also assists in the review of the Committee’s discussion of our executive compensation program included under the heading “COMPENSATION DISCUSSIONAND ANALYSIS,” and additional information about Pay Governance’s work with theCNG Committee is contained under that heading. While Pay Governance’s advice is a resource considered by the Committee in its decision-making process, other than in a consulting and advisory capacity, Pay Governance has no role in the Committee’s compensation decisions or recommendations made to the Boards.directed to: During early January 2021, representatives of Pay Governance met with the Committee to present its market and peer analyses and to discuss

● establish our executive and director compensation, market conditions and recent trends in executive compensation practices, ouroverall compensation philosophy and various considerations that may affect the Committee’s executivepractices and director compensation decisions. Those representatives also met with our Chief Executive Officer to discuss the results of the market and peer analyses, our business strategies and management’s recommendations for 2021 base salary rates of executive officers and LTIP award grants. Pay Governance participated in a later meeting during early 2021 at which the Committee formulated and approved its recommendations to our Boards for 2021 executive base salary rates and 2021 director compensation, approved new LTIP award grants for the 2021-2023 performance period, and determined the amounts of payments to be made for LTIP awards previously granted for the just- ended 2018-2020 performance period. Pay Governance served as the Committee’s independent consultant and, during 2021, did not provide other services for us or FCB. In accordance with Nasdaq’s listing requirements, each year the Committee reviews various factors (including the factors described in rules of the SEC) that may pose a conflict of interest on the part of its consultants and advisors as well as their individual representatives who provide services to the Committee. No conflict of interest was identified in the most recentregularly review regarding Pay Governance.

The Compensation, Nominations and Governance Committee reviews its engagement of Pay Governance each year, and the Committee may engage different consultants at any time.

Effect of Risk Management on Compensation

The Compensation, Nominations and Governance Committee regularly reviews our compensation philosophy and practicesthem to determine the overall risk profile of our compensation program. As a part of that risk oversight process, onprogram;

● oversee an annual basis the Committee reviewsreview all of our and FCB’s compensation plans, including all incentive and variable pay plans within specific divisions of FCB, to identify anydetermine whether there are potential risksareas of risk that reasonably could be expected to have a material adverse effect on our business and financial results, and to ensure continuing oversight and mitigation of risk within our and FCB’s compensation practices. Atpractices; ● administer and approve all grants of award opportunities and payments of awards under FCB’s LTIP and MPP; ● review and make recommendations to the Boards regarding all other executive compensation matters, including: Ø amounts of cash and other compensation paid or provided to, and the adoption of or revisions to compensation, incentive, retirement, or other benefit plans that affect, our and FCB’s Chief Executive Officer and other executive officers; and Ø at the request of the RiskBoards, amounts of cash and other compensation paid or provided to, and the adoption of or revisions to compensation, incentive, retirement, or other benefit plans that affect, other individually named officers or associates. |

Committee prior to the CIT Merger. Pay Governance’s engagement each year contemplates that it will prepare market and peer analyses comparing our executives’ and directors’ compensation rates to the market compensation paid by similar financial services organizations to their officers and directors in similar positions, advise the Committee regarding its responsibilities and developments in compensation rules and practices, consult with our management and the Committee regarding our annual and strategic plans and the formulation of their compensation recommendations, and assist the Committee in its consideration of new, and changes to existing, compensation plans and strategies. Pay Governance also assists in the review of the discussion of our executive compensation program included under the heading “COMPENSATION DISCUSSION AND ANALYSIS.” Additional information about Pay Governance’s work with the Committee is contained under that heading. While Pay Governance’s advice is a resource considered by the Committee in its decision-making process, other than in a consulting and advisory capacity Pay Governance has no role in the Committee’s compensation decisions or recommendations made to the Boards. | | | | | | 38 | |  2024 Annual Proxy Statement 2024 Annual Proxy Statement

| | |

Committees of Our Boards The following chart describes the process through which executive compensation decisions are made by the CNG Committee. | | | | | | | | | | | | | |

HOW WE PLAN COMPENSATION | | | | | | | | | Our Chief Executive Officer | | | | | | Independent Executive Compensation Consulting Firm | | | | | | CNG Committee | ● Chief Executive Officer provides information about individual officers’ performance and his recommendations for their compensation. ● Management consults with our executive compensation consulting firm regarding our annual and strategic plans and market conditions, our compensation philosophy, and the Compensation, Nominations and Governance Committee will make reports or provide information regarding matters relevantformulation of our consultant’s compensation recommendations. | |

| | ● Reports to the Risk Committee’s oversightCNG Committee on trends in executive compensation practices, and prepares market and peer analyses comparing our executives’ and directors’ compensation to the market compensation paid by similar financial services organizations to their officers and directors in similar positions. ● Advises the CNG Committee regarding its responsibilities for our enterprise-wide Risk Management Framework. and developments in compensation rules and practices.Our executive officers participate● Assists the CNG Committee in FCB’sits decisions regarding new LTIP and certain business unitsMPP awards, the formulation of its executive compensation recommendations to the Boards, and divisions within FCB have incentive, commissionits consideration of new and variable paychanges to existing compensation plans that have unique structures, goals and reward levels in which other officers and associates participate. The Committee believes that, as currently administered, the LTIP is focused on performance goals that are aligned with our shareholders’ long-term interests, that none of those other plans provide for award levels that are over-weighted to a specific business unit or service, and that those other plans are structured in ways that the Committee believes protect our organization. Based on its most recent review, the Committee believes our and FCB’s current plans present no risk elements that reasonably could be expected to have a material adverse effect on our business and financial results.strategies.

Compensation Committee Report

This report has been furnished by the Compensation, Nominations and Governance Committee, the members of which are named below,● Assists in the Committee’s capacity asreview of the Boards’ joint compensation committee. The Committee has:

| ● | | reviewed and discussed with management the Compensation Discussion and Analysis that is included in this proxy statement; and

|

| ● | | based on that review and discussion recommended to the full Board of Directors that the Compensation Discussion and Analysis be included in our proxy statement and Annual Report on Form 10-K for the year ended December 31, 2021.

|

The Compensation, Nominations and Governance Committee:

| | | | | | | Robert T. Newcomb | | Victor E. Bell III | | H. Lee Durham, Jr. | | Robert E. Mason IV |

COMPENSATION DISCUSSION AND ANALYSIS

In this section, we describe the material components of our executive compensation program forincluded under the heading “COMPENSATION DISCUSSION AND ANALYSIS.”

| |

| | ● Makes the final decisions concerning payments and awards under the LTIP and MPP. ● In coordination with our “named executive officers” whose compensation is set forth inChief Human Resources Officer and his staff, reviews and makes recommendations to the 2021 Summary Compensation TableBoards regarding amounts of salaries and other compensation paid or provided to our executive officers. ● Considers the results of its annual evaluation of our Chief Executive Officer’s performance in setting his compensation, along with the voting results from the most recent “say-on-pay” resolutions submitted to our stockholders. ● Reviews and makes recommendations to the Boards regarding amounts of compensation paid or provided to our directors. |

During early January 2023, representatives of Pay Governance met with the Committee to present its market and peer analyses and to discuss our executive and director compensation, market conditions and recent trends in executive compensation practices, our compensation philosophy, and various considerations that may affect the Committee’s executive and director compensation decisions. Those representatives also met with our Chief Executive Officer to discuss the results of the market and peer analyses, our business strategies, and management’s recommendations for 2023 base salary rates of executive officers and LTIP and MPP award grants. Pay Governance participated in a later meeting during early 2023 at which the Committee formulated and approved its recommendations to our Boards for 2023 executive base salary rates and 2023 director compensation, approved new LTIP award grants for the 2023-2025 | | | | | | | 2024 Annual Proxy Statement  | | 39 |

Committees of Our Boards Performance Period and MPP award opportunities related to the CIT Merger for 2023, and determined the amounts of payments to be made for LTIP awards previously granted for the just-ended 2020-2022 Performance Period and for MPP awards for 2022. During the remainder of 2023, Pay Governance met with the Committee during May to discuss executive compensation, including post-acquisition compensation design, and during July, following the SVB Acquisition, to discuss the July 2023 MPP awards and the compensation of our directors. Pay Governance served as the Committee’s independent consultant and, during 2023, did not provide other services for us or FCB. In accordance with Nasdaq’s listing requirements, each year the Committee reviews various factors (including the factors described in rules of the SEC) that may pose a conflict of interest on the part of its consultants and advisors as well as their individual representatives who provide services to the Committee. No conflict of interest was identified in the most recent review regarding Pay Governance. The CNG Committee reviews its engagement of Pay Governance each year, and the Committee may engage different consultants at any time. Effect of Risk Management on Compensation The CNG Committee is accountable for oversight of our compensation philosophy and practices to determine the overall risk profile of our compensation program. As a part of that risk oversight process, the Committee oversees an annual review of all of our and FCB’s compensation plans, including all incentive and variable pay plans within specific divisions of FCB, to identify any potential risks that reasonably could be expected to have a material adverse effect on our business and financial results, and to help ensure continuing oversight and mitigation of risk within our compensation practices. The Risk Committee may request reports or information from the CNG Committee regarding matters relevant to the Risk Committee’s oversight responsibilities for our enterprise-wide Risk Management Framework. During 2023, we began implementation of enhancements to the Incentive Compensation Risk Management Program, including new risk-balancing mechanisms. Those mechanisms include a compilation of results by control function for each business unit, with business units that experience an adverse risk outcome receiving an assessment of individuals responsible for the adverse outcome based on various matters, including compliance failures, sales practices, ethics policy violations, significant operational losses, or other significant risk events. The goal of the assessments is to help identify and mitigate imprudent risk taking within business units, including risk taking that may arise from incentive compensation arrangements. Our executive officers participate in FCB’s LTIP and MPP, and certain business units and divisions within FCB have incentive, commission, and variable pay plans that have unique structures, goals, and reward levels in which other officers and associates participate. The Committee believes that, as currently administered, the LTIP and MPP are focused on performance goals that are aligned with our stockholders’ long-term interests, that none of those other plans provide for award levels that are over-weighted to a specific business unit or service, and that those other plans are structured in ways that the Committee believes protect our organization. Compensation Committee Report This report has been furnished by the CNG Committee, the members of which are named below, in the Committee’s capacity as the Boards’ joint compensation committee. The Committee has: | ● | | reviewed and discussed with management the Compensation Discussion and Analysis that is included in this proxy statement; and |

| ● | | based on that review and discussion, recommended to the full Board of Directors that the Compensation Discussion and Analysis be included in our proxy statement and 2023 Annual Report. |

The Compensation, Nominations and Governance Committee: | | | | | | | | | | Robert T. Newcomb | | Victor E. Bell III | | H. Lee Durham, Jr. | | David G. Leitch | | Robert E. Mason IV |

| | | | | | 40 | |  2024 Annual Proxy Statement 2024 Annual Proxy Statement

| | |

Compensation Discussion and Analysis COMPENSATION DISCUSSION AND ANALYSIS In this section, we describe the material components of our executive compensation program for the executive officers named in the 2023 Summary Compensation Table and other compensation tables under the heading “EXECUTIVE COMPENSATION,” who we refer to in this discussion as our “NEOs.” This discussion also provides an overview of our compensation philosophy and objectives, and how and why our CNG Committee implements compensation processes and arrives at specific compensation decisions and recommendations for our NEOs. Our 2023 NEOs are listed below, with their positions during 2023 (which they continue to hold), in the order in which they appear in the Summary Compensation Table. | | | | | | | | |

Frank B. Holding, Jr. Chairman and Chief Executive Officer | |

Craig L. Nix Chief Financial Officer | |

Hope H. Bryant Vice Chairwoman | |

Peter M. Bristow President | |

Lorie K. Rupp Chief Risk Officer |

TABLEOF CONTENTS | | | | | | | 2024 Annual Proxy Statement  | | 41 |

Compensation Discussion and Analysis EXECUTIVE SUMMARY Our Executive Compensation Philosophy and Objectives The CNG Committee endeavors to align executive officers’ compensation with our long-term business philosophy and achieve our objectives of: | ● | | rewarding sustained long-term performance, service, and loyalty; |

| ● | | balancing business risk with sound financial policy and stockholders’ interests, and aligning the interests of our executive officers with the long-term interests of our stockholders by encouraging growth in the value of our company and our stockholders’ investments; |

| ● | | enabling us to attract, motivate, and retain qualified executive officers; and |

| ● | | providing compensation to our executive officers that is competitive with comparable financial services companies. |

Because the performance-based compensation of our executive officers is paid in cash and does not include equity-based compensation, we do not have stock ownership requirements or guidelines for executive officers. However, as discussed elsewhere in this proxy statement, our Board has adopted a policy that prohibits our executive officers from hedging, or pledging as collateral for any loan, any shares of our common stock they own, subject to exceptions for certain “grandfathered” pledges and certain pledges approved by our Audit Committee following a review of relevant factors. For purposes of the policy, a “hedge” means any financial instrument, derivative transaction, or trading strategy designed to hedge or offset any decrease in the market value of our stock, such as a covered call, collar, prepaid variable forward sale contract, equity swap, exchange fund, or similar transaction. Executive Compensation Highlights Our executive compensation program is administered by the CNG Committee, which is focused on performance-based components of executive compensation in order to promote performance that will increase stockholder value and improve the overall effectiveness of our compensation program. During 2023, the Committee again engaged Pay Governance to evaluate our executive compensation and assist the Committee in maintaining a program that is both fair and effective. The following paragraphs summarize the Committee’s and our Boards’ actions and decisions with respect to the compensation of our NEOs for 2023 and 2024. 2023 Compensation Actions and Decisions | ● | | Base Salaries — In January 2023, the Committee recommended and the Boards approved no changes in the base salary rates of our NEOs for 2023. |

| ● | | Continued Use of Growth in Tangible Book Value as the LTIP Performance Metric — As noted below, the Committee continued to use growth in the tangible book value of our common stock as the primary component of the performance measure for the determination of LTIP awards. Tangible book value per share is defined as an amount equal to our total assets, minus our intangible assets, minus our liabilities, divided by the aggregate number of outstanding shares of both classes of our common stock. The central objective of our strategic plan is to build the long-term value of our company and our stockholders’ investments, and the Committee believes growth in tangible book value per share is a key driver of long-term value. As a result, the Committee believes the performance goals under our LTIP, from which our executives derive a substantial portion of their compensation, are consistent with our focus on long-term objectives and emphasis on financial stability and growth in stockholder value, which are factors that have contributed to our financial success over the years. |

| ● | | Long-Term Incentive Plan (“LTIP”) New Awards and Payments: |

| Ø | | In January 2023, the Committee approved the grant of cash-based LTIP performance awards to our NEOs for a three-year 2023-2025 Performance Period based on the same performance measure used in prior years — the growth rate of our tangible book value, plus dividends paid (the “TBV+D Growth Rate”), subject to certain adjustments. As with the grants made in 2022, the Committee set the Threshold, Target, and Stretch TBV+D Growth Rate goals of 12%, 30%, and 48%, respectively, with payment opportunities for performance at those levels to be based on 50%, 100%, and 150% of the Target Amounts of the awards. |

| Ø | | During January 2024, the Committee approved payment of the three-year cash performance awards previously granted under the heading “EXECUTIVE COMPENSATION.” This discussion also provides an overview of our compensation philosophy and objectives, and how and why our and FCB’s Boards��� joint Compensation, Nominations and Governance Committee implements compensation processes and arrives at specific compensation decisions and recommendations involvingLTIP for the named executive officers. Our 2021 named executive officers2021-2023 Performance Period, which are listed below in the order in which they appear in the Summary Compensation Table, and we refer to themreported in this discussionproxy statement as our “NEOs.” | ● | | Frank B. Holding, Jr. – Chairman and Chief Executive Officer

|

| ● | | Craig L. Nix – Chief Financial Officer

|

| ● | | Hope H. Bryant – Vice Chairwoman

|

| ● | | Peter M. Bristow – President

|

| ● | | Lorie K. Rupp – Chief Risk Officer

|

Executive Summary

Executive Compensation Highlights

Our executive compensation program is administered by our Compensation, Nominationsfor 2023.

|

| | | | | | 42 | |  2024 Annual Proxy Statement 2024 Annual Proxy Statement

| | |

Compensation Discussion and Analysis | ● | | Merger Performance Plan (“MPP”) New Awards and Governance Committee, which is a joint committee of our and FCB’s Boards of Directors. The Committee has continued to focus on performance-based components of executive compensation in order to improve the overall effectiveness of our compensation program. During 2021,Payments: |

| Ø | | In February 2023, the Committee again engaged Pay Governance LLC to evaluate our executive compensation componentsapproved new MPP cash performance award opportunities for 2023, which could become payable at Target levels dependent on continued achievement of CIT Merger integration and assistconversion milestones, realization of remaining merger cost savings, and leveraging of merger synergies and benefits, as well as individual performance. |

| Ø | | In July 2023, following the SVB Acquisition, the Committee in maintaining a program that is both fairapproved performance award opportunities under the MPP for 2023, which could become payable at Threshold, Target, and effective. The following paragraphs summarizeMaximum levels dependent on achievement of integration and conversion milestones, the Committee’s actionsrealization of cost savings and decisionssynergies, and risk management objectives, as well as individual performance, related to the SVB Acquisition. |

| Ø | | In January 2024, the Committee assessed achievement of performance objectives with respect to the 2023 MPP awards and approved payment of the February MPP awards related to the CIT Merger and the July MPP awards related to the SVB Acquisition to each our NEOs at the maximum levels, all of which are reported in this proxy statement as compensation for 2023. |

| ● | | No Change in Control Arrangements or Stock-Based Compensation — We have no employment or change of control agreements with any of our current NEOs and we have not provided them with any equity or stock-based compensation. |

| ● | | Continued Focus on Performance-Based Compensation — By recommending no increases for 2023 in the base salaries of our NEOs, maintaining increased individual “Stretch” opportunity levels with respect to LTIP awards granted for 2021the 2023-2025 Performance Period at 150% of the Target Amounts (as compared to 125% for awards granted prior to 2022), and 2022. | | ●2021 Compensation Actions and Decisions

| | ●Base Salaries – In January 2021, the Committee recommended, and FCB’s Board approved, a 2.96% increase for 2021 in the base salary of Mr. Holding, our Chief Executive Officer, increases of 3.70% in Mrs. Bryant’s and Mr. Bristow’s base salaries, and increases of 6.30% and 10.00% respectively, in Mr. Nix’s and Mrs. Rupp’s base salaries.

| | ●LTIP Award Payments and Grants – In January 2021, the Committee approved payments for the three-year, cash-basedapproving award opportunities to NEOs under the MPP with performance objectives including integration and conversion milestones, cost savings and synergies, and risk management, as well as individual performance, awards previously granted under the LTIP for the 2018-2020 performance period, which were reported in our proxy statement for the 2021 Annual Meeting as compensation for 2020. The Committee also approved the grant of cash-based LTIP performance awards for a new three-year performance period (2021-2023) based on the same performance criteria as in prior years (the “TBV+D Growth Rate,” which is defined as the growth in the tangible book value per share of our common stock plus cumulative dividends paid per share on the stock) and with the same Threshold, Target and Stretch performance goals as in the previous year’s awards. Based on comparisons to market data, Target Amounts (as defined below) for the 2021-2023 LTIP awards were based on higher percentages of the NEOs’ base salary rates than in previous years. Finally, during January 2022, the Committee approved payments for the three-year awards previously granted under the LTIP for the 2019-2021 performance period, which are reported in this proxy statement as compensation for 2021.

| | ●Bonuses – During January 2022, the Committee recommended, and FCB’s Board approved, payment of special merger-related cash bonuses for 2021 to certain of our executive officers and associates. These “merger success” bonuses were intended to recognize the performance and contributions of and additional demands on our management team during late 2020 and through 2021 (including integration planning and addressing Federal and State regulatory issues) in connection with our merger with CIT. As a result of their efforts and achievements, our transformational merger with CIT received final regulatory approval on December 17, 2021, and was successfully completed on January 3, 2022. The merger has more than doubled our assets to over $100 billion and significantly increased the breadth and complexity of our business with the addition of multiple new business lines.

| | ●Non-Qualified Deferred Compensation Plan – During February 2021, the Committee recommended, and FCB’s Board approved, a non-qualified deferred compensation plan that became effective on March 1, 2021, and permits plan participants to save for retirement and other long-term financial goals on a tax-deferred basis by electing to defer their receipt of up to 80% of their base salaries and certain eligible bonuses, including LTIP award payments. FCB credits

|

| participants’ deferred amounts with deemed investment returns based on hypothetical investment options selected by the participants from a menu of investment options which are used only for purposes of measuring the amounts to be credited by FCB to participants’ accounts. The Plan does not provide for FCB to make any additional or discretionary contributions to the participants’ Plan accounts.

| | ●Performance-Based Compensation Relative to Total Compensation – By recommending relatively modest increases for 2021 in the base salaries of our NEOs and increasing the individual target opportunity levels with respect to new LTIP awards granted for the 2021-2023 performance period, the Committee continued to focus on performance-based compensation as a substantial component of our NEOs’ total compensation.

| | ●Continued Use of Tangible Book Value as LTIP Performance Metric – The Committee continued to use growth in the tangible book value of our common stock as the primary performance criteria for the determination of LTIP award payments. Tangible book value per share is defined as an amount equal to our total assets, minus our intangible assets, minus our liabilities, divided by the aggregate number of outstanding shares of both classes of our common stock. The central objective of our strategic plan is to build the long-term value of our company and our shareholders’ investments, and the Committee believes growth in tangible book value per share is a key driver of long-term value. As a result, the Committee believes the performance goals under our LTIP, from which our executives derive a substantial portion of their compensation, are consistent with our focus on long-term objectives and emphasis on financial stability and growth in shareholder value which are factors that have contributed to our financial success over the years.

|

| ● | | | ●No Change in Control Arrangements or Stock-Based Compensation – We have no employment or change of control agreements with any of our named NEOs and we have not provided them with any equity or stock-based compensation.

| | ●January 2022 Compensation Actions and Decisions

| | ●Base Salaries – The Committee recommended no increases in the base salaries of our NEOs for 2022.

| | ●LTIP Award Payments and Grants – The Committee approved the grant of cash-based LTIP performance awards for a new, three-year 2022-2024 performance period based on the same TBV+D Growth Rate performance criteria as in prior years. However, to account for the future impact of the CIT merger on the attainability of performance goals, the Committee increased Target and Stretch TBV+D Growth Rate goals to 30% and 48%, respectively (as compared to 24% and 36% for the previous year’s awards) and set Target Amounts of the awards based on the same percentages of the NEOs’ base salary rates as in the previous year’s awards. The Committee increased the potential payment for performance at the higher Stretch level to 150% of the Target Amount of the awards as compared to prior Stretch level payouts of 125% of Target Amounts.

| | ●Amendment to LTIP – The Committee recommended, and FCB’s Board approved, an amendment to the LTIP that, for awards granted beginning in 2022, increased the maximum amount payable for any award from $7 million to $10 million. TheCommittee also modified its standard form of award agreement to impose non-solicitation and nondisclosure obligations on participants as conditions to awards beginning in 2022.

|

Our ExecutiveIncentive Compensation Philosophy and Objectives

Risk Management Program.The Committee endeavorsand the Boards’ began implementation of enhancements to both align our executive officers’ compensation with our long-term business philosophy and achieve our objectives of: | ● | | rewarding sustained long-term performance and long-term service and loyalty;

|

| ● | | balancing business risk with sound financial policy and shareholders’ interests, and aligning the interests of our executive officers with the long-term interests of our shareholders by encouraging growth in the value of our company and our shareholders’ investments;

|

| ● | | enabling us to attract, motivate and retain qualified executive officers; and

|

| ● | | providing compensation to our executive officers that is competitive with comparable financial services companies.

|